GBCI 2024: Investing safely and securely in high complexity jurisdictions

In the first of three themes explored in TMF Group’s Global Business Complexity Index (GBCI) 2024, we analyse the impact of global regulatory compliance on foreign investments and explore what organisations are doing to mitigate the risks associated with changing legislation.

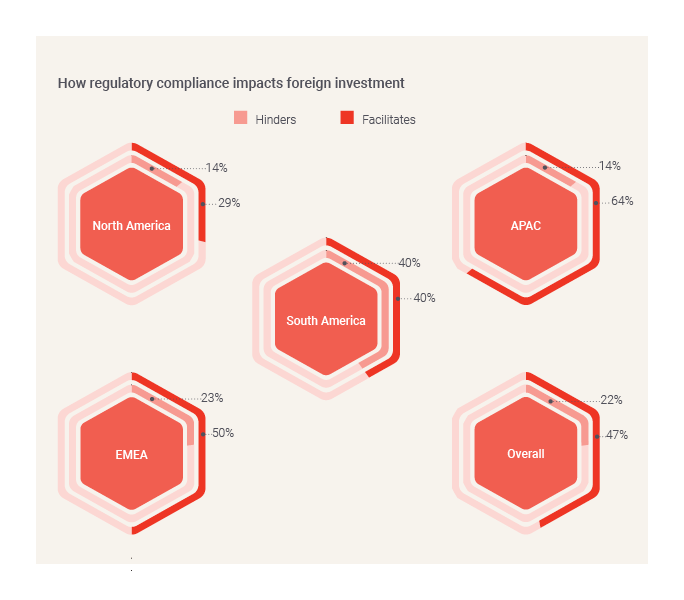

Regulatory risk has been identified as the most challenging factor for investors worldwide. But despite some shifts in regulatory compliance in the last year, many experts report their clients to be prepared for future reporting obligations, with nearly half asserting that regulatory compliance actually facilitates foreign investment. Of the 22% that find regulation hinders investment, rule complexity, language barriers and a lack of clarity were found to be key drivers.

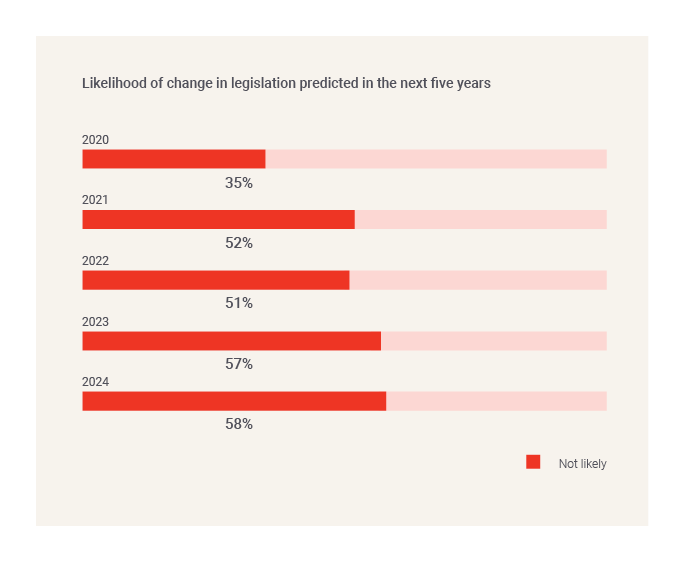

Over half of TMF Group experts report confidence in legislation stability in the next five years

A majority of jurisdictions expressed confidence in legislation stability over the next five years, representing a continued upward trajectory on previous years. In 2020, for example, just 35% of jurisdictions predicted it to be likely that there would be no significant change in legislation. Year on year, the sense that no significant change will occur has increased. This jumped a considerable 17 percentage points to 52% in 2021. In 2023, the proportion of jurisdictions predicting no significant change jumped again to 57%, with only a marginal increase to 58% in 2024.

Trends in reporting on ultimate beneficial owners (UBO) and persons of significant control (PSC), as well as regulations around Know Your Customer (KYC) and anti-money laundering (AML) have been core parts of compliance processes in locations around the world for a number of years. And while there may be a minority of jurisdictions lagging behind on these fronts, regulation has been an important method of holding businesses to account on both transparency and safety. This helps to explain confidence in legislative stability in the medium term.

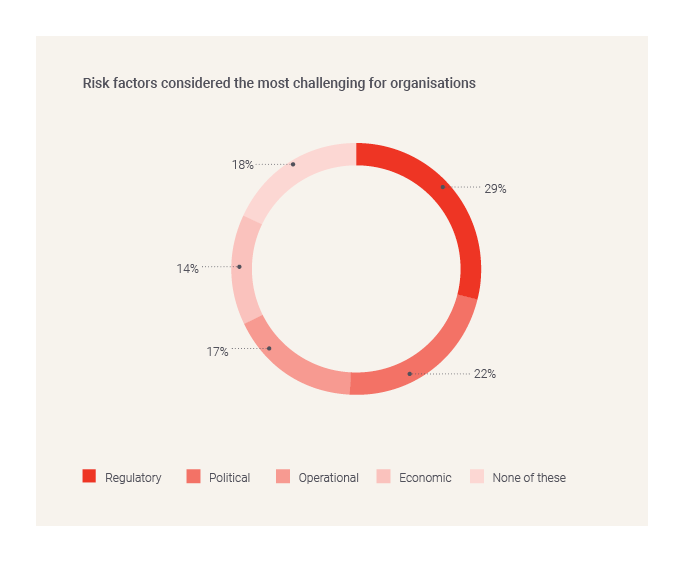

Regulatory risk is the most challenging factor for investors worldwide, but political risk is impacting two-thirds of South American jurisdictions

Labour regulations (38%), tax regulations (26%) and regulatory compliance (12%) were identified as the core complexities within regulatory risk. TMF Group experts highlighted that rather than the amount or complexity of legislation posing a challenge, it is instead the speed with which regulatory changes are introduced where the true difficulty lies. Multiple jurisdictions spoke about minimal but regular changes to regulatory compliance requiring action within days of introduction.

The government is always changing the rules and regulations for tax applications. In some cases, that is with immediate effect. For example, they can announce the new VAT rate for all goods and services on a Friday night and after Monday, all the new rates should be applicable.

However, when split by region or complexity, high proportions of South American (60%) and North American (46%) jurisdictions, as well as half of those in the top 10 most complex, identified political risk as a challenging factor. Experts identified recent changes in government or upcoming elections as key markers of risk. TMF Group experts operating in North and South American jurisdictions described political risk as much harder for international businesses to mitigate against. They explained how political changes can have a knock-on impact on regulation, taxation and trading policies, which can, in turn, make a jurisdiction much less attractive to invest in. The wholescale and unpredictable nature of these changes and the speed with which they occur – given the political landscape – can make it difficult for international businesses to develop strategies to offset the risk.

We’ve got a two-party election in the US. So, whatever they come back with… I don’t think that there is a significant percentage in the population that support either… People are going to see that from an investment perspective and they may sit on the sidelines for a few months, trying to figure out how that should even play out.

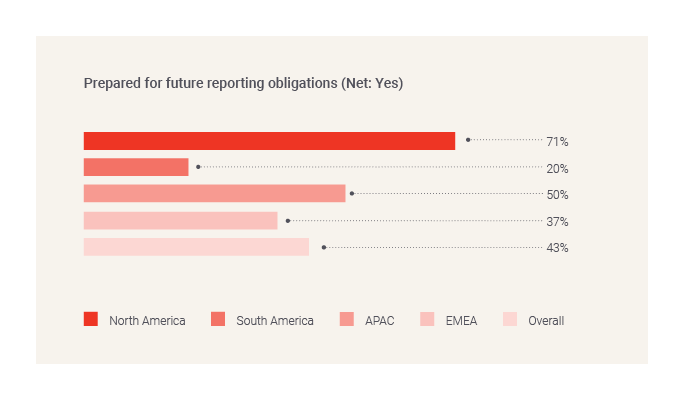

Despite some changes to regulatory compliance, two in five TMF Group experts report that their clients are prepared for future reporting obligations

Of the jurisdictions that foresee further regulatory compliance, nearly half feel prepared for future reporting obligations. This is particularly high for jurisdictions in North America, at 71%, when compared to an overall 43%. Comparably, it is particularly low for jurisdictions in South America at 20%.

Some jurisdictions shared that changes in regulatory compliance reporting typically only impact larger companies operating in their jurisdictions. Many of these larger companies operate on a global scale and, as such, are accustomed to completing reporting for other jurisdictions. Therefore, any changes to reporting will have a minimal impact.

It’s only major institutional banks, large companies and listed companies. For them, you'd already be doing much of this anyway.

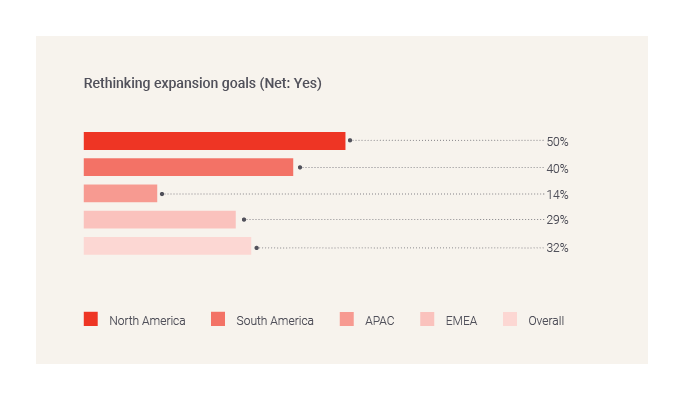

Just one third of those surveyed are rethinking expansion goals given changes in regulatory reporting requirements, indicating a level of preparedness for upcoming shifts.

However, despite global regulatory compliance plans seemingly not deterring expansion on the whole, 50% of North American jurisdictions are rethinking their expansion goals. This could involve businesses pausing incorporation within a jurisdiction due to sizeable compliance reporting requirements, or businesses looking at other jurisdictions with more lenient rules. This can point to the importance of local experts in communicating the compliance processes and requirements to new entrants, so that reporting requirements are not seen as a barrier.

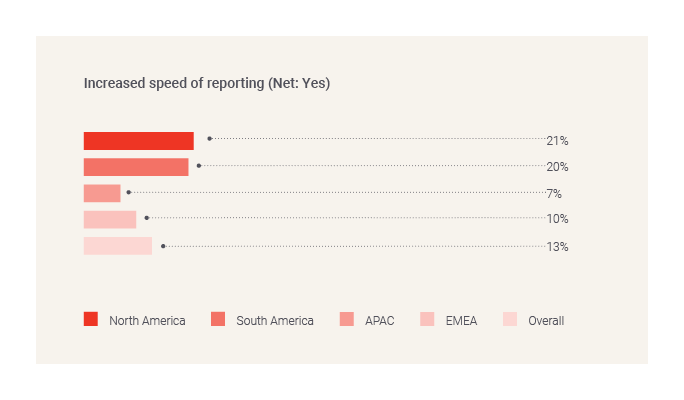

In line with the fact that large proportions of jurisdictions are prepared for future reporting obligations, very few feel that the speed of reporting requirements will increase. This may explain why only a third (32%) of jurisdictions are reconsidering expansion goals as a result of increased regulatory compliance. With a steady rate of reporting required, businesses may develop such an expertise in reporting requirements that they become business as usual.

In contrast, as before, more North and South American jurisdictions predict an increased speed of reporting, at 21% and 20% respectively. This is consistent with these jurisdictions rethinking their expansion goals, given that businesses will not only have to navigate greater reporting demands, but they may also be expected to do so more quickly than before.

Of the 22% that find regulation hinders investment, complexity, language barriers and a lack of clarity are key drivers

TMF Group experts cited the multiple laws or decrees with strict compliance as causing increased complexity. Data protection regulations were regularly identified as one such example – with severe sanctions if not adhered to.

Another layer of complexity is often driven by the need for local reports and documents to be written in local languages in order for organisations to be compliant. Not only does this require experts with local and up-to-date knowledge of an area, but a level of linguistic skill as well.

Some of the main challenges associated with regulatory obligations in France include navigating a strict and dense regulatory environment, as well as overcoming the language barrier, since the use of French

is required.

In jurisdictions where regulations were complex, TMF Group experts reported that there often is a lack of clarity or transparency in how regulations need to be applied. Some jurisdictions mentioned inconsistency in advice or instruction between government documents or bodies.

Regulatory obligation in South Africa often lacks proper insight – it often tries to provide a one-size-fits-all approach and often falls under corporate dispute.

In contrast, nearly half of TMF Group experts report that regulatory compliance facilitates foreign investment

Nonetheless, increased regulatory compliance requirements are not necessarily viewed in a negative light. In fact, nearly half of TMF Group experts report that regulatory compliance actually facilitates foreign investment. In the scenarios where regulatory compliance facilitates foreign investment, TMF Group experts spoke of the positive benefits associated with accountability. Regulation such as UBO registration or KYC and AML requirements boost confidence in financial markets, as investors feel more confident in the accuracy and transparency of funds.

Interestingly though, half of the top 10 most complex jurisdictions (50%) report that regulatory compliance hinders foreign investment, compared to just 10% of the bottom 10 jurisdictions. Meanwhile, seven of the bottom 10 least complex jurisdictions report that regulatory compliance facilitates foreign investment.

This relates to what drives the complexity of adhering to regulation. For those considered more complex, lack of clarity and changeable regulation discourage investment. However, for those considered less complex, strong regulatory compliance offers both accountability of and protections for investments.

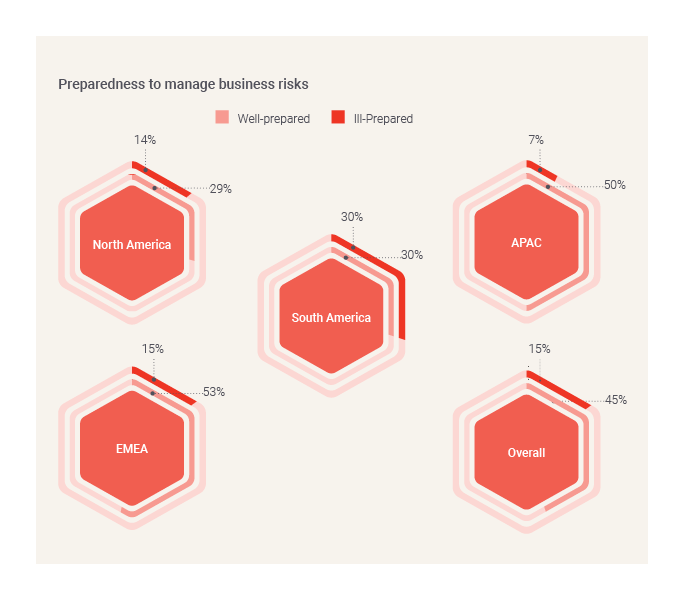

Almost half of jurisdictions are well-prepared to manage risks, but South America is lagging behind

On the surface, GBCI data suggests that jurisdictions are mostly well-prepared to manage business risk. However, North America and EMEA are the only regions where jurisdictions identified themselves as very well-prepared. The majority of the least complex jurisdictions are well-prepared to manage risks (80%), compared to one in five of the most complex jurisdictions (20%).

Of course, preparedness for risk may depend on the type of risk a jurisdiction faces. TMF Group experts described regulatory risk being easier to prepare for, given the ability to easily predict certain trends within the business environment. What is less easy to predict is political risk, which can see changes to the business environment required at pace.

To increase preparedness, jurisdictions regularly engage local experts to stay informed of changes

Engaging local experts is one crucial method by which organisations can increase their preparedness for risk.

Legal advisors, tax consultants, compliance officers and even labour representatives are often employed by businesses to counter the regulatory complexities of their jurisdictions. Others outsource compliance tasks to avoid the risk of non-adherence.

Given the often quick pace of change, several TMF Group experts mentioned the importance of staying up to date with legislative and regulatory requirements. This involves regular professional training, updates from regulatory bodies and ongoing research into the regulatory environment.

To comply with frequent law changes, clients either check the regulation changes by themselves or turn to their service provider, tax or legal advisors or outsource their financial activity.

The Global Business Complexity Index 2024

This article is an extract from TMF Group’s latest report, the Global Business Complexity Index 2024.

Explore the GBCI rankings, analysis and global trends, to help you cut through the layers of corporate compliance complexity – download the full report here.

To find out more about the drivers of business complexity in the jurisdictions that matter to you, explore our Complexity Insights Dashboard.